Make the Money You EARN Go Farther and Compound Exponentially!

Get on the list! When you subscribe to the Money Hacks newsletter, you will get periodic updates in the world of MONEY.

How the U.S. Dollar Became the World’s Boss

Picture this: It’s 1944, World War II is still raging, and 44 countries send their smartest money people to a sleepy little town in New Hampshire called Bretton Woods. They’re there to figure out one thing: How the hell do we rebuild the world economy once the shooting

Don't know where to start?

Explore our most popular learning topics.

Articles on all your favorite money subjects

Mortgage payments are now lower than rent in 22 US cities

(NewsNation) — With mortgage rates falling, monthly home payments are now less

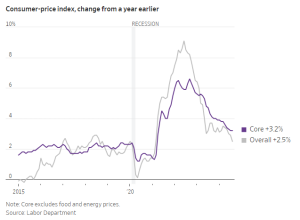

Inflation Extends Cooling Streak to Hit 2.5% in August

Inflation eased in August to new three-year lows, teeing up the Federal

Top 10 Reasons and Timings for Mortgage Refinancing

Secure significant long-term savings by refinancing your mortgage when interest rates drop

Avoid Common Mistakes When Applying for a Mortgage

When applying for a mortgage, make sure you get pre-approved to determine

7 Key Steps to Compare Mortgage Options Effectively

When evaluating mortgage options, start by examining your finances thoroughly. Consider income,

10 Best Strategies for Your Mortgage Down Payment

To boost your mortgage down payment savings, start with a separate account

About the author

“

This site is so full of tips and tricks to save & invest money! I love it.

You'd be a fool to pass this site by.

John Ramos

“

Money Hacks is incredible! I am so glad I found it. I've learned a ton about saving and investing without spending a dime on expensive money managers.

Annie Smith

Get all our updates. Subscribe right away!